The Netherlands joined the US chip war against China on Wednesday, announcing plans to further restrict exports of critical chipmaking technology to protect national security.

Dutch Trade Minister Liesje Schreinemacher announced the decision in a letter to parliament, saying the restrictions will be introduced before the summer.

“Because the Netherlands considers it necessary on national security grounds to get this technology into oversight with the greatest of speed, the Cabinet will introduce a national control list,” the letter said.

Also on read: Money Alone Can’t Rescue China’s Chip Sector, Experts Say

Schreinemacher’s letter did not name China, a key Dutch trading partner, nor did it name ASML, Europe’s largest tech firm and a major supplier to semiconductor manufacturers, but both will be affected.

It specified one technology that will be impacted is “DUV” (deep ultraviolet) lithography systems, the second-most advanced machines that ASML sells to computer chip manufacturers.

The announcement marks the first concrete move by the Dutch to join the US effort to curb chip exports to China. Washington imposed sweeping export restrictions on shipments of American chipmaking tools to China last year aiming to hobble its semiconductor industry and slow Beijing’s military advances.

‘Careful, precise’ measures

ASML controls more than 90% of the market for lithography machines which use powerful lasers to create the minute circuitry of computer chips. Each machine can cost as much as $160 million.

China, the world’s biggest consumer of computer chips, is ASML’s third largest market, after Taiwan and South Korea. It represents around 16% of ASML’s 2021 sales, or 2.1 billion euros ($2.35 billion).

The Dutch announcement leaves major questions unanswered, including whether ASML will be able to service the more than 8 billion euros worth of DUV machines it has sold to customers in China since 2014.

Also on AF: ASML’s Taiwan Expansion Signals Chip Sector’s Next Big Leap

Schreinemacher said the Dutch government had decided on measures “as carefully and precisely as possible … to avoid unnecessary disruption of value chains.”

“It is for companies of importance to know what they are facing and to have time to adjust to new rules,” she wrote.

ASML said in a response it expects to have to apply for licenses to export the most advanced segment among its DUV machines, but that would not impact its 2023 financial guidance.

Update from Japan likely

ASML has has been restricted from selling its most advanced “EUV” (extreme ultraviolet) machines to China since 2019.

The bulk of its “DUV” sales in China go to relatively less advanced chipmakers. Its biggest South Korean customers, Samsung and SK Hynix both have significant manufacturing capacity in China.

ASML expects sales in China to remain about flat at 2.2 billion euros in 2023, implying relative shrinkage as the company expects overall sales to grow by 25%. Meanwhile, major ASML customers such as TSMC and Intel are engaged in capacity expansions.

The US has been lobbying Netherlands and Japan, key suppliers of chipmaking technology, to join its chip war against China.

Washington has deemed their participation necessary for restrictions to be effective and the allied countries have been in talks on the matter for months.

Japan is expected to issue an update on its chip equipment export policies as soon as this week, sources said.

- Reuters, with additional editing by Vishakha Saxena

Also read:

South Korea Warns US Chips Act Could Backfire, Harm Investment

Japan May Opt for Milder Chip Curbs on China Than US: Lawmaker

Chip Executives Replace Pony Ma, Jack Ma at Key China Meet

US Chips Act Fund Ban on China Expansion For 10 Years – FT

ASML Accuses China Employee of Chip Tech Theft – FT

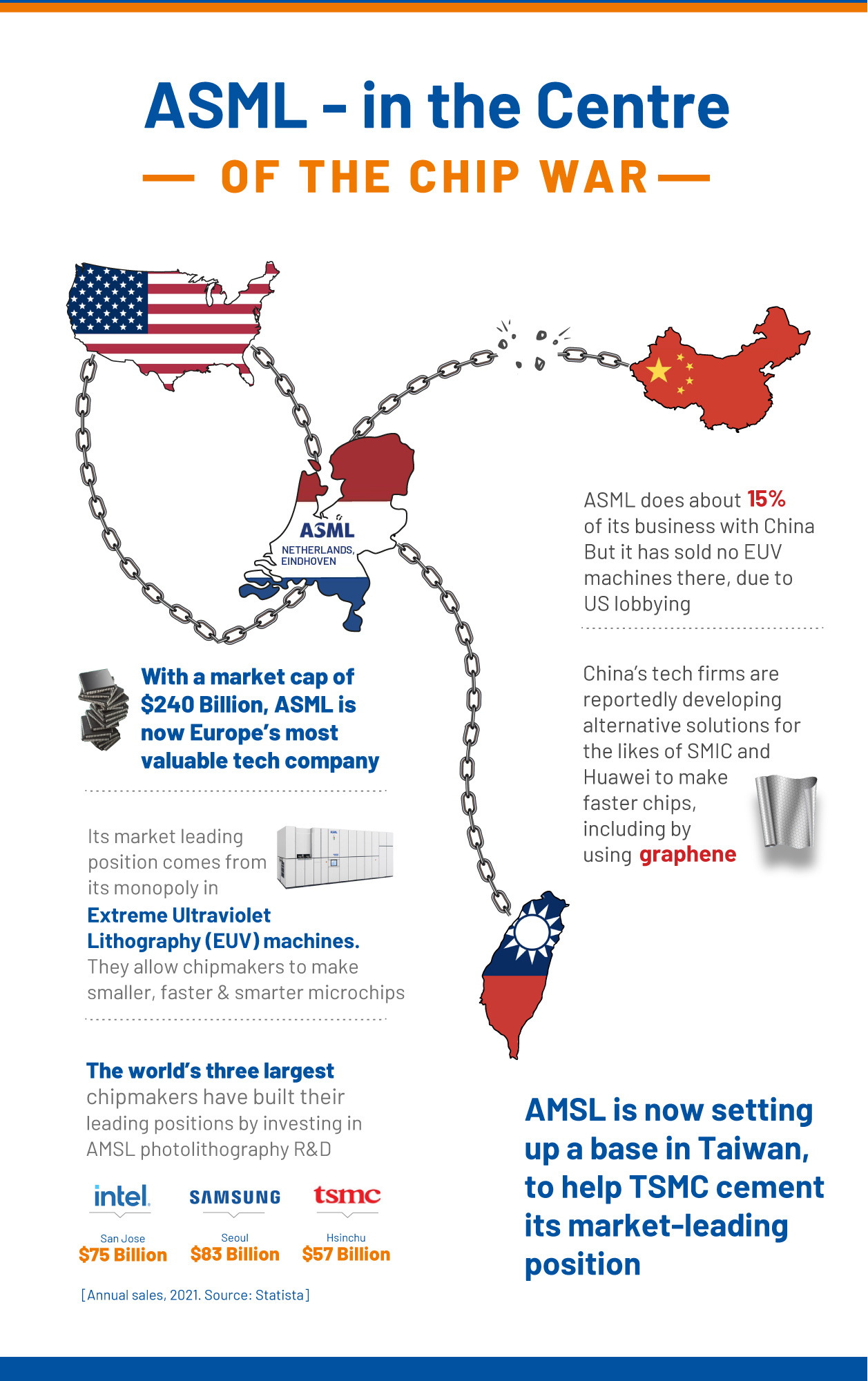

Infographic: ASML in the Centre of the Chip War