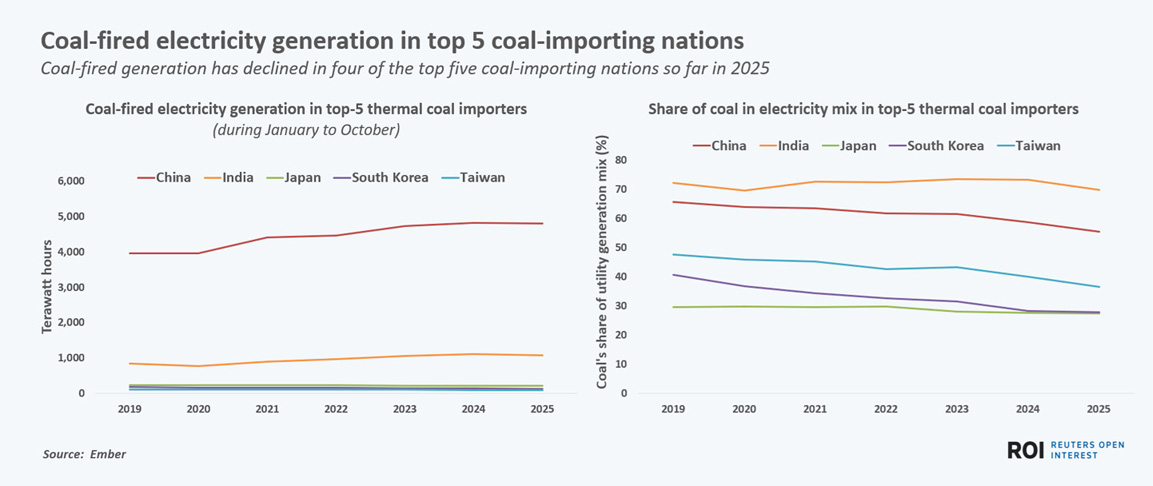

Asia’s two biggest polluters, India and China, cut their reliance on coal for electricity generation in 2025 – the first time in 52 years the two fossil fuel-guzzlers posted a simultaneous drop, Carbon Brief has reported.

India’s electricity generation from coal fell by 3% year-on-year, while China’s dropped by 1.6%, according to an analysis by the Centre for Research on Energy and Clean Air (CREA) for Carbon Brief.

These declines mean that both countries “now have the preconditions in place for peaking coal-fired power”, CREA reported, adding that the fall could also help reach a peak in global emissions.

Also on AF: Trump’s ‘Tariff on States Trading With Iran’ Could Kill China Truce

Weaning the world off coal is considered vital to achieving global climate targets, but the fossil fuel remains the single biggest fuel used to make electricity.

China and India are among the biggest emitters of greenhouse gases in the world. According to CREA, power sectors of the two countries accounted for 93% of the rise in global carbon emissions between 2015 and 2024.

But both countries also lead Asia in clean energy, having added record levels of renewables last year. 2025 would mark the peak of their coal use “if China is able to sustain clean-energy growth and India meets its renewable energy targets,” CREA’s lead analyst Lauri Myllyvirta wrote for Carbon Brief.

ALSO SEE: Trump’s ‘Tariff on States Trading With Iran’ Could Kill China Truce

China’s current capacity to generate clean energy is already enough for the country to no longer increase its coal use, Myllyvirta noted.

India’s planned increases in clean energy capacity is also enough to hit a peak in coal use before 2030, he added. 2025 was the first time renewable growth helped reduce the country’s coal use for electricity.

Key challenges remain

For China and India to sustain lower coal use in energy generation, both countries will need to take measures to improve their grids in favour of renewables. India will also need to boost policies and regulatory support for its planned clean energy projects.

Last year, Reuters reported that India’s stranded renewable power capacity – projects awarded but unable to come online – more than doubled due to unfinished transmission lines, and legal and regulatory delays.

India is also facing challenges due to the integration of surplus clean energy into the grid, which curbed power output for most months last year. To meet its energy requirements, India plans to increase its coal power capacity by 46% from current levels by 2030.

A top power ministry official said in December that India would take the next three years to understand how power demand is growing and the speed of integration of clean energy into the grid.

It will also evaluate the cost of storing excess clean energy in batteries and sending it to the grid, before making decisions on adding more coal capacity beyond 2035.

Several Indian utilities have also signed long-term contracts with coal-fired power generators to meet a projected surge in evening demand.

Still, the contraction in 2025 is only the third time in five decades that India’s coal use has declined. It was largely due to intense monsoons, which increased hydropower and depressed electricity demand.

The fast growth of renewable capacity is also a direct result of a record-fast rollout of power supplies from solar and wind farms, as well as the highest generation from hydro dams in more than six years, Reuters reported last month.

With clean generation from all sources expected to keep climbing on the back of an ongoing push to expand India’s clean power capacity, further cuts to both coal’s share of the generation mix and total coal use in India could emerge.

China is key

Meanwhile, the fall in China’s coal use for 2025 was put down to a sustained growth in renewable energy and largely flat power demand.

Last month, the IEA noted that global use of coal is set to decline by 2030, thanks largely to declines in China.

“China… which consumes 30% more coal than the rest of the world put together, is the main driver of global coal trends,” Keisuke Sadamori, IEA director of energy markets and security, said.

That would also mean that faster-than-expected electricity demand growth, or slower renewable integration in China, could push global demand above forecasts, the IEA noted.

Despite those concerns, however, the combined declines in India and China’s coal use are significant to global efforts to cut emissions.

“While many challenges remain, the decline in their coal-power output marks a historic moment,” CREA’s Myllyvirta said.

- Vishakha Saxena, with Reuters

Also read:

India’s Green Transition In A Chokehold

Asia’s Billion-Dollar Carbon Boom?

China’s One Trillion Watt Solar Journey

Surge in Solar Power, Data Centres Spurs Battery Boom in China

China’s Fossil Fuel Power Generation Set For First Fall In A Decade

Renewables Top Coal Power for First Time in First Half of 2025

US Says Hidden Radios Found in Solar Highway Tech From China

New Tax Cuts To Accelerate India’s Shift To Solar, Wind Energy

Solar Power Boom Surging in Indonesia, Australia, Africa

China Lays Down Law to Solar Panel Makers: End Overproduction

China’s Desert Greening Projects Altering its Water Table: Study

Asia-Pacific ‘Faces $500bn Yearly Floods Hit if Warming Continues’